The Poor Man's

Covered Call investment

strategy

-

The basic idea is this...

when writing a Covered Call

you own the shares and

you're giving someone the

right but not the obligation

to take your shares from you

for a price you pick for a

timeframe you pick, they pay

you a premieum to do this

The Poor Man's Covered

Call substitutes the 'owning

the stock' part and replaces

it with you purchasing a

LEAP for protection ... yet

still writing near term

covered calls.

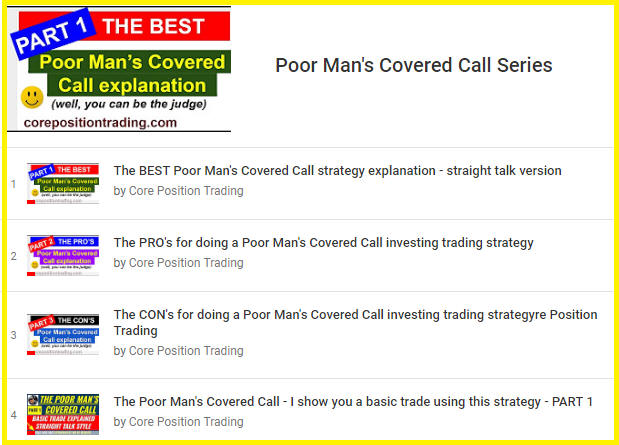

I've

done a Youtube video

learning series that

explains this strategy which

I suggest you watch if

you're new to this strategy

but want to try. Click below

and be sure to 'Subscribe'

to my Youtube channel

because I will be doing

video's throughout the year

on this strategy and we talk

about it 'Straight talk

style' so we understand it.

Also, be sure to

download your FREE

copy of the Poor

Man's

Covered Call Tracker

Spreadsheet IF

you're thinking of

this strategy to

track all your

trades.. its FREE

and has NO HOOKS ...

I offer it up for

free to Up Our Game!

|

|